And you can use the exact same Excel spreadsheet I use for calculating a company's intrinsic value. Download Britt's Intrinsic Value Spreadsheet (temporarily disabled) Just replace the numbers in the yellow-highlighted cells with your company's numbers, and the spreadsheet will calculate a value titled 'Multiple' on line 29. Type '=SUM(D1:D100)' into cell G1. Change 'D100' to the address of a cell from column D that contains the value 0. Cell G1 calculates the shares' intrinsic value. With this example, it shows a value of $354.31. Intrinsic Value Calculation. The most common method applied in calculating intrinsic value is Discounted Cash Flow, but whichever formula you choose to calculate DCF, calculation of intrinsic value is an important decision as it helps to determine that whether you are paying the right price or not. Calculating intrinsic value of call options. Call intrinsic value = MAX of (stock price less strike price OR zero) Calculating intrinsic value of put options. Put intrinsic value = MAX of (strike price less stock price OR zero) Learn the logic, not the formulas. Nevertheless, the recommendation now is: do not memorize the formulas. How to Calculate Intrinsic Values of Shares in Excel Using a dividend discount model makes calculating intrinsic value fairly simple.

The Famous Intrinsic Value calculation written by Benjamin Graham. The Intrinsic Value formula is also know as the “Benjamin Graham” formula. Benjamin Graham’s wrote the book “The Intelligent Investor” first published in 1949. The Intelligent Investor is a famous book among Value Investors. Value Investors have been using The Intrinsic Value calculation since Benjamin Graham invented it. Benjamin Graham often known as the “Father of Value investing”.

The Intrinsic Value calculation still work those days, try it out yourself with this free online Intrinsic Value calculator.

If you like the free online Intrinsic Value Calculator you can make a donation to help us continue this website.

How to calculate Intrinsic Value Formula?

“Benjamin Graham” was aninvestor and professor, and also considered as the “Father of value investment”.

In 1962, Benjamin Graham described a formula, but later on, he made a number of changes and altered or revised it again in 1974 ((Benjamin Graham, “The Decade 1965-1974: Its significance for Financial Analysts,” The Renaissance of Value).

The described formula is given below;

Intrinsic Value = EPS x ( 8.5 + 2g) x 4.4

Y

EPS: the company’s last 12-month earnings per share.0006

8.5: the constant represents the appropriate P-E ratio for a no-growthcompany as proposed by Graham.

g: long-term (five years) earnings growth estimate of the company.

Y: the current yield on a AAA rated corporate bond.

Graham Intrinsic Value Formula Excel

This is the revised version from Benjamin Graham. Benjamin Graham revised his original formula from the “The Intelligent Investor” in the year 1974. We are using the revised version because Graham’s original Intrinsic Value is based on figures from back in the days.

This model discusses theaspects of both market-related and company-specific variables.

If a company manager has to take decision of buying or selling a stock,then company’s relative Graham value (RGV) has to be calculated, and if it isgreater than one, then it is undervalued and must be purchased, and if lessthan one, then must be sold. It can be calculated by dividing stock’s intrinsicvalue by its current price.

RGV = Intrinsic Value

Intrinsic Value

In finance, company and its stocks are valued in terms of different values. Market value and intrinsic values are the two basic values among all of them. It refers to the actual value of a company, or a stock which is usually calculated by fundamental analysis. That’s why; it is also called fundamental value of that company, asset, or a stock. This value can be same as market value of that asset, but it is not necessary. Intrinsic value of any asset is its true value and can differ from its market value too.

A number of benefits an investor can get from determining this value of their stock. Major benefit is that they are able to know the true and actual value of their stock, instead of just believing in the recent market value of the stock.

As, market value contains a number of other factors in calculation of asset’s value, intrinsic value tells us the pure value of a stock. So, with the help of this value, an investor can get the information about how rationally his stocks are priced.

Intrinsic Value Calculator Excel Download

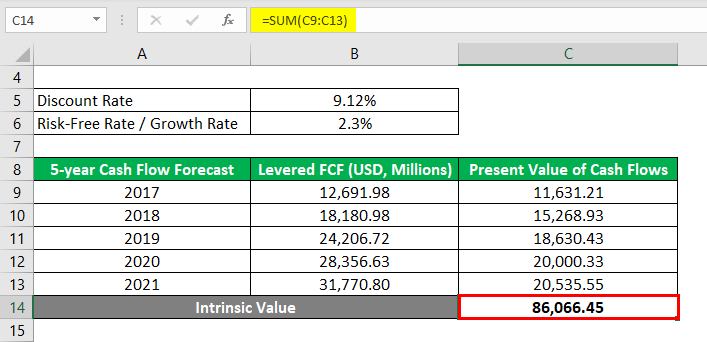

A particular method to calculate and to determine this value consists of two steps;

- Summing-up the future income generated by that particular asset.

- Discount this sum to the present value.

Intrinsic Value in Other Cases

Intrinsic value is not only has uses in the case of stockbut also used in describing the values of options, securities and the realestates. In the case of options, an option has an intrinsic value, when it isin-the money. If it is out of the money, it adopts the value of zero. For an inthe money option, intrinsic value is found out by difference in the values ofcurrent price of the underlying commodity or stock and the stock price of theoption. And the total value of this option is calculated by summing up the bothintrinsic and time value. Similarly, in real estates, the intrinsic value iscalculated by the net present value of expected future cash inflows which couldbe generated if the property was given at a rent price.